Can You Still Contribute To 2025 Roth Ira. In this case, you contribute money to a traditional ira and then immediately convert it to a roth ira — before you take a tax deduction and before any earnings. You cannot make contributions to a roth ira past the limit.

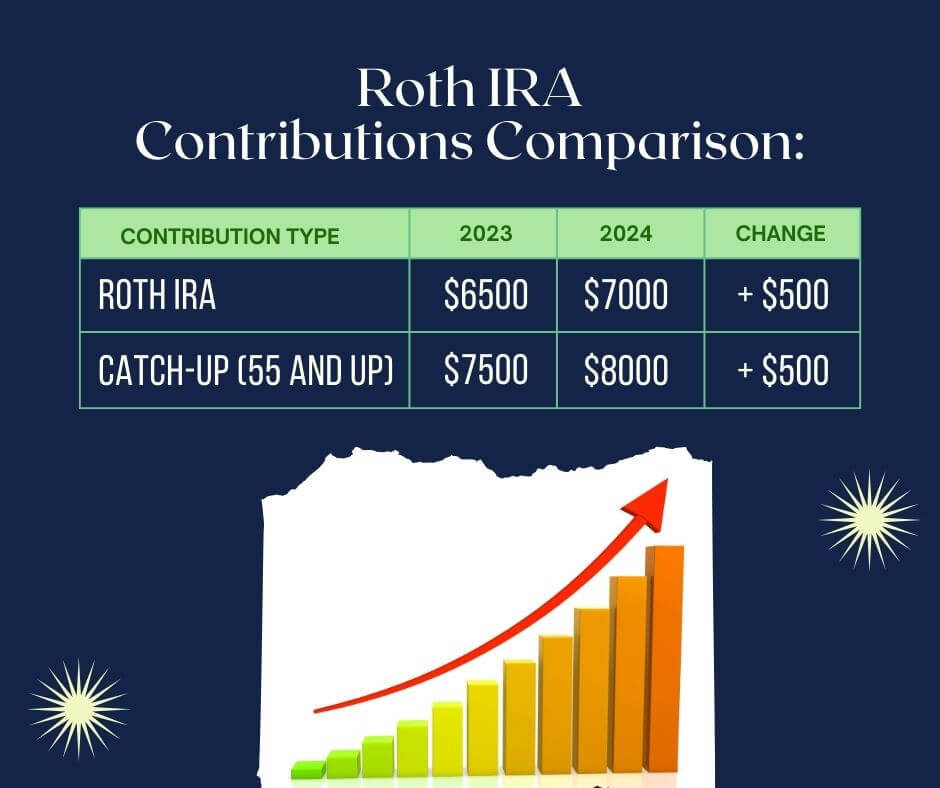

The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. Depending on your magi, filing status, and earned income, you may be able to make the federal maximum contribution to your roth ira ($6,500 for those under 50;

You Can Keep Contributing To A Roth Ira After Retirement, As Long As You Have Some Earned Income.

For the 2024 tax year, you and your child can contribute a maximum of $7,000 to their roth ira, as long as their modified adjusted gross income is under.

The Roth Ira Contribution Limit For 2024 Is $7,000 For Those Under 50, And $8,000 For Those 50 And Older.

You can also contribute the full $7,000 to a roth ira for 2024.

Can You Still Contribute To 2025 Roth Ira Images References :

Source: www.youtube.com

Source: www.youtube.com

Can You Contribute to a Roth IRA in Retirement? YouTube, You can also contribute the full $7,000 to a roth ira for 2024. You can leave amounts in your roth ira as long as you live.

Source: www.pinterest.com

Source: www.pinterest.com

Roth IRA Contribution Limits Yes! You can still contribute even if, If your magi is less than $146,000, you can contribute the. For the 2024 tax year, married individuals filing jointly with a modified adjusted gross income.

Source: www.youtube.com

Source: www.youtube.com

Can You Contribute to a Roth IRA After a Roth Conversion? YouTube, I can't even find the. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Source: moneybliss.org

Source: moneybliss.org

Can You Have Multiple Roth IRAs? 3 Things You Need to Know Money Bliss, Use nerdwallet's free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira. However, for traditional iras, you can continue to invest money above the limit but will lose the.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

The Ultimate Roth IRA Guide District Capital Management, You can make 2024 ira contributions until the. Any amount you contribute adds to your roth.

Source: dodiqjeannie.pages.dev

Source: dodiqjeannie.pages.dev

How Much Can I Contribute To Roth Ira In 2024 Elyse Imogene, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Source: www.youtube.com

Source: www.youtube.com

Can I still make an IRA or Roth IRA contribution for 2022? YouTube, However, for traditional iras, you can continue to invest money above the limit but will lose the. In 2023, you can contribute up to $6,000, or $7,000 if you’re age 50 or older, to all of your roth and traditional ira accounts.

Source: inflationprotection.org

Source: inflationprotection.org

Roth IRA Limits Can You Make Too Much Money to Contribute, You cannot make contributions to a roth ira past the limit. For instance, you can contribute up to $23,000 to a 401 (k) by the last business day of 2024.

Source: www.youtube.com

Source: www.youtube.com

Who Can Contribute to a Roth IRA? YouTube, For the 2024 tax year, you and your child can contribute a maximum of $7,000 to their roth ira, as long as their modified adjusted gross income is under. There are also income requirements to contribute to a roth ira.

Source: kizziewmoyna.pages.dev

Source: kizziewmoyna.pages.dev

Can You Still Contribute To 2024 Roth Ira Kenna Alameda, If you are 50 and older, you can contribute an additional $1,000 for a. For 2025, it would be thursday, january 2nd.

For Example, Say That You Exceeded Your Roth Contributions By.

The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

If Your Contribution Is Reduced Because Of Your Income, Contributing To A Roth (If You're Eligible) Can Still Be An Option.

Starting in 2024, rmds will no longer be required from roth accounts in employer retirement plans.

Category: 2025